TAIL-RISK HEDGING

A systematic hedge tactic to cushion a deep, sudden market drop.

Outlier Protection

Optional added hedge layer

Mean Reversion

Reduce cost of protection

Increased Comfort

Sleep better

Our Approach

New Feature: Due to increased interest, our Dynamic Hedge Strategy (DHS) has rolled out a systematic hedge tactic to cushion for a deep, sudden market drop.

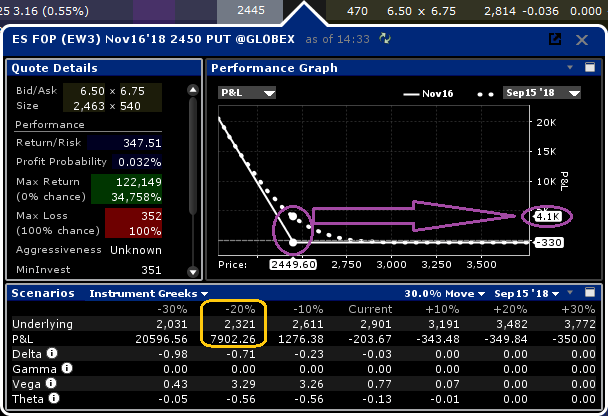

Details: Enter a 2 month -15% Out-the-money (OTM) Put on the S&P when

the index is trading statistically overbought.

Hedge ratio can be either 50% or 100% of underlying estimated beta. This is in addition to our "DHS" program and on an opt-in basis.