INVESTMENT PHILOSOPHY

Business Cycle Analysis:

The current stage of the US business cycle is evaluated (against its Secular backdrop) in terms of historical liquidity, profit and inflation cycles. Factors evaluated include: consumer expectations, industrial production, yield curve dynamics, interest rates and inflation. As the focus is on the US cycle, global cycles are viewed within their own stages (e.g., euro core tends to lag US, China and Japan generally are taken in isolation).

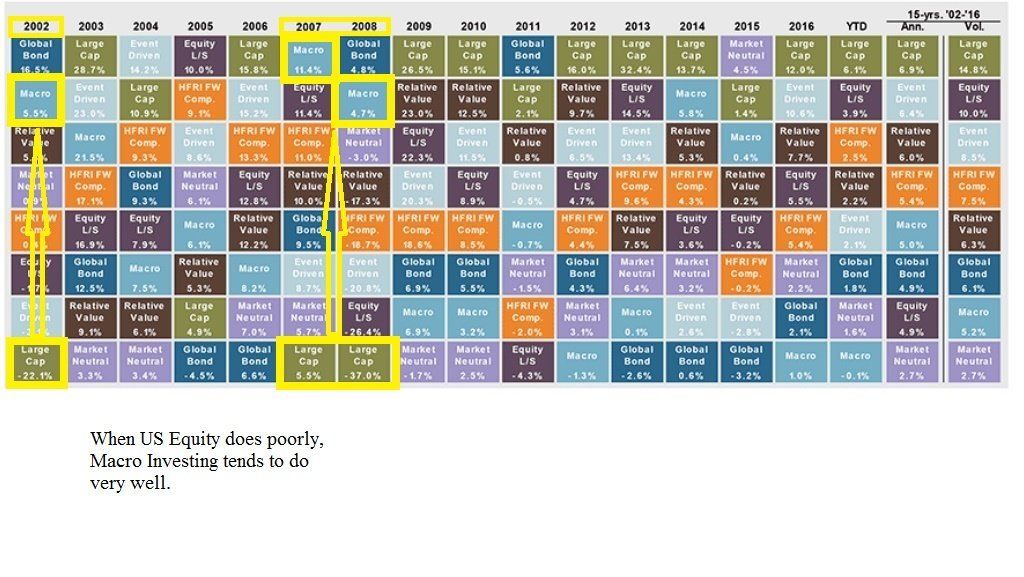

Intermarket Analysis:

Long and short-term historical analysis of key asset class trends, relationships and sequence dynamics assist in telling an economic story (e.g., inflationary or deflationary pressures) that links and confirms the current business cycle stage. This economic story and cycle stage helps dictate the most favorable asset allocation.

Quantitative Model:

A model is deployed for position size adjustments and hedging activity. Option time-decay and reversal strategies then seek to capture the mean reverting tendency intrinsic to each asset classes own historical “extreme” trading levels.

Market Psychology:

A quantitative and qualitative review is performed on all key asset classes psychological tone. We want to know if a market is discounted or if a trade is too crowded-out.

Dynamic Hedge Strategy (DHS):

Within equity portfolios, a twelve step “depth chart” proprietary model flows as the equity market bull/bear cycle progresses. Adjustments are made to equity sector holdings, amount invested and hedges applied. Some of the various inputs are: yield curve slope, volatility curve, investor sentiment, price momentum, market internals and more. Call writes are used as a first layer of hedging after parabolic moves, S&P Puts are then added during waning momentum and lastly other long term tactics employed should a bear market develop. Hedging portfolio drag is minimized when warranted via put spreads.

Expanded strategy details available upon request.

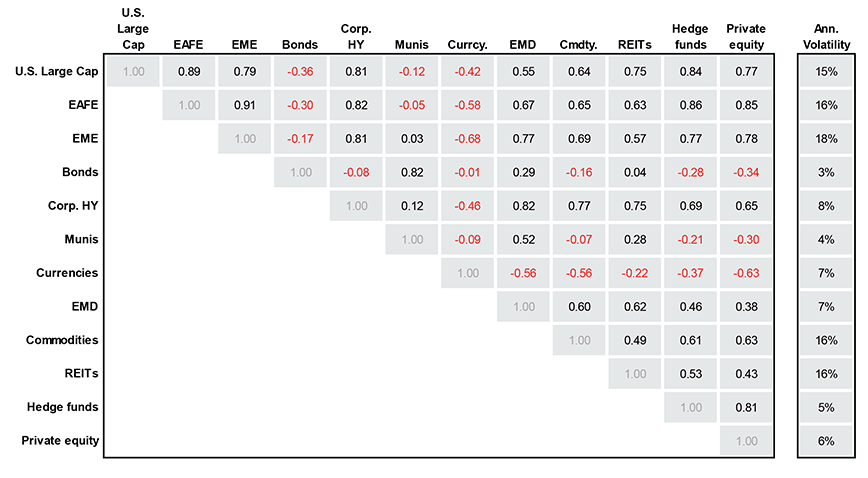

DIVERSIFICATION & CORRELATION