HOW MOST

dEAL With RISK

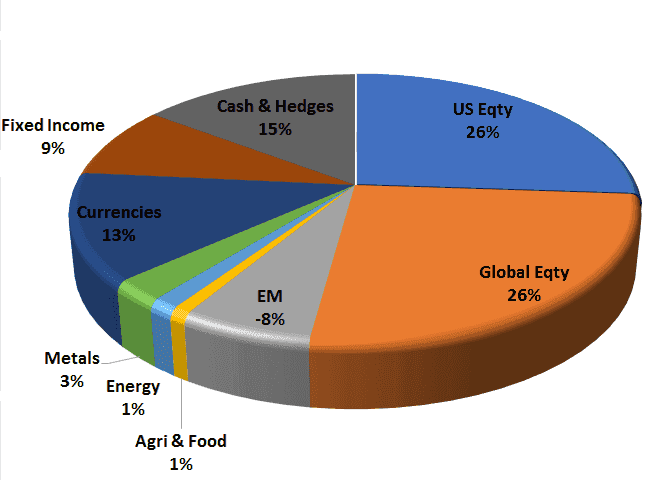

hALLMARKS WE EMBRACE

BUT A problem…

LEAVES YOU EXPOSED!

The numbers you need to know

-40%

Decline

Price 🔽 (Bear Market avg.)

4Yrs

Time

Time to breakeven (Bear Market avg.)

60/40

Diversify

Even when Bonds "worked" in 2009, it took 3 years to breakeven with 60%/40% (stock/ bond) portfolios

1.7%

Bond hedging Efficacy loss possible due to low interest rates & high inflation

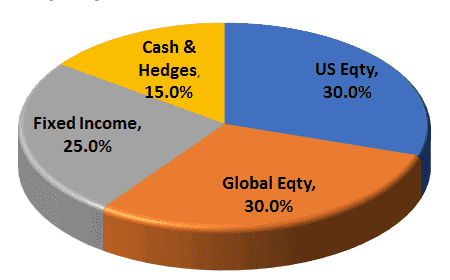

First grow portfolio

Using our Investing Best Practices, we build a globally diversified portfolio designed to reach your:

- Goals

- Risk Tolerance

- Time Frame

Most advisors stop here.

Thus leaving you risk-exposed. So, let's fix this!

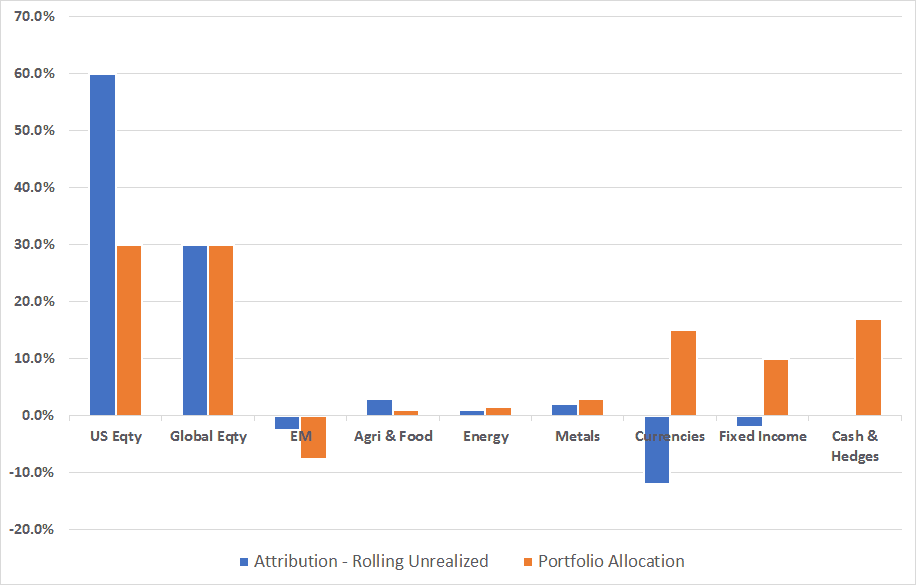

Then protect it

We then tactically mitigate the downside when deemed most advantageous and stand back if all clear.

Value-Add Goals:

- Cut (or eliminate) negative drawdowns

- Reduce time to breakeven

- Elevated launch-point for subsequent recovery

- Enhanced flexibility to seize opportunity when others panic

Convert Problems

Into Opportunity

New ParagraphINVESTMENT PORTFOLIOS

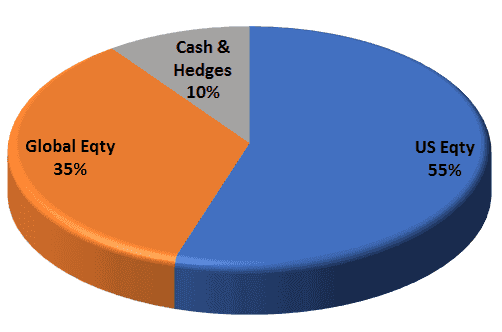

CORE PORTFOLIOS

Managed on your behalf, we offer key portfolios that are fully scalable to satisfy your needs.